In today’s business landscape, where 84% of companies recognize the importance of innovation for strategic growth but only 6% of CEOs are satisfied with innovation performance, board composition plays a crucial role.

Board composition refers to the structure and diversity of individuals serving on a board of directors or governing body, encompassing factors such as skills, expertise, background, and representation, aiming to ensure effective governance and decision-making within an organization.

Let’s learn how the board structure impacts the corporate strategy and discover the board of directors composition best practices.

Discover effective management tool for your board

Rely on our choice – Ideals Board

Visit WebsiteWhat is a board composition?

Board of directors composition refers to the makeup and characteristics of individuals who serve on a board of directors or governing body of an organization. The composition of the board of directors has the following elements:

- Size. Your organization should have enough directors to supervise the nominating and governance committee, audit committee, and other board subdivisions.

- Experience and qualifications. Board directors should have sufficient expertise in investing, finances, management, and other areas to run the business professionally.

- Diversity. Companies must have at least two diverse board members to meet the Securities and Exchange Commission requirements.

How board skills impact business performance

A well-structured board of directors significantly improves company results. The more skills the board has, the more skills gaps it can fill, which is positive for risk management and overall business performance.

However, studies show that “the more, the better” isn’t true for all contexts and business models. So let’s see how the skills and backgrounds of board directors impact business performance.

Board’s skill sets

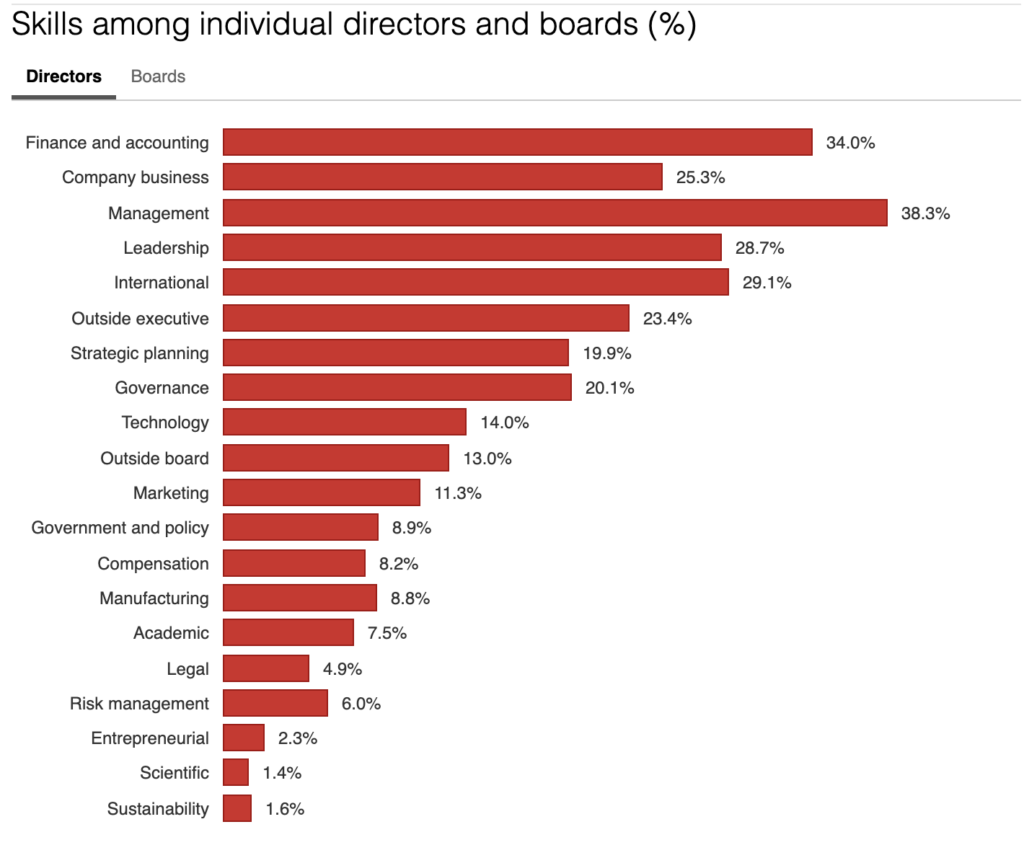

The University of Melbourne studied the impact of board skills on business performance. It evaluated skill sets among boards and delivered the following conclusions: Most boards have nine skills. Finance, company business, management, leadership, international, outside executive, strategic planning, governance, and technology skills are the most common in U.S. corporate boards.

- Three skills are the most prevalent in individual directors. Finance, management, and international experience are prevalent in at least one-third of individual board members.

- The optimal number of skills per board is ten. More skills degrade business performance. The study shows that firms lose 2.4% in performance if their boards have 11-13 skills.

- Less skill diversity is better for impactful decision-making. The study concludes that diverse expertise creates more disputes among board directors, leading to decision-making problems. Meanwhile, board members with more homogeneous skill sets share visions and communicate more effectively.

| ✅ Main insight: – Nominating and governance committees have sufficient expertise in core business functions in most U.S. boards. – Up to ten skills per board of directors ensures balanced skill diversity, sound decision-making, and optimal business performance. – In boards with 11+ skills, diversity-driven decision-making delays outweigh the benefits of multifaceted experiences. |

Educational backgrounds

The educational backgrounds of board members, including C-suite executives, also impact business performance, although backed by limited research data in developed and developing countries. A study on Taiwanese companies concludes the following:

- Educational backgrounds are relevant in C-suite executives. CEOs with Ph.D. and MBA degrees deliver 11% higher results in public companies three years post-IPO.

- The educational backgrounds of non-executive directors don’t significantly impact business performance. Ph.D. and MSC degrees either didn’t correlate with leverage ratios and capital structures or had a ~ 1% negative impact. The study suggests the following results may originate from overconfidence bias.

| ✅ Main insight: It’s advisable to prioritize skills and experiences rather than educational backgrounds while selecting non-executive directors. Meanwhile, MBA and Ph.D. degrees in C-suite executives positively impact business performance. |

4 board composition best practices

Check the board composition best practices based on years of corporate research:

1. Keeping boards small

According to Korn Ferry, Russel 3,000 companies have an average of 9 board directors, while S&P companies have 12. The board size averages between 10 and 11 members worldwide, including the UK, Italy, and Spain.

However, Joseph E. Griesedieck, Vice Chairman at Korn Ferry, says 12 board directors is too much for optimal board governance. Bigger board sizes mean more viewpoints and discrepancies in decision-making between inside and outside directors.

Instead, companies should reduce their boards to 7 or 10 members, according to Charles Elson, director of the University of Delaware’s Corporate Governance Center.

It’s easier for C-suite executives to communicate with fewer board directors. Most importantly, 7 or 10 people are enough to supervise board committees efficiently.

2. Refreshing boards regularly

Only 57% of board directors oversee shareholder communications, according to PWC’s 2023 board effectiveness survey. Additionally, more than 89% of directors want to change at least one board member, while 41% insist on replacing at least two.

This survey indicates that evaluating board composition is crucial for tackling evolving challenges and supervising operations. Also, the Institutional Shareholder Services (ISS) considers the average board tenure of 9 years to be excessive.

So PWC recommends the following board refreshment practices for corporate boards:

- Set a turnover action program and replace individual directors once in five years.

- Set maximum board tenure limits at 9-12 years.

- Conduct a regular board evaluation.

3. Emphasizing cybersecurity

According to Forbes, the global cybercrime cost will reach $8 trillion by the end of 2023 and $10.5 trillion by 2025. As of 2022, 83% of companies experienced one or more data breaches.

Meanwhile, board directors need relevant cybersecurity expertise, although 70% of boards have cybersecurity on their agenda. Only 14% of company board seats went to cybersecurity experts in 2022, a 3% decline from 2021.

If your board enumerates ten directors, it should have at least two or three members with solid board cybersecurity experience within the IT governance board.

4. Promoting age diversity

These days, board diversity provides measurable benefits to business performance. However, boards often overlook the age aspect of the diverse board.

The average age of a board director is 63 years. However, PWC’s recent study on board age diversity has found that younger board directors contribute to higher adaptation and profitability metrics in their organizations.

In today’s changing world, age diversity brings a good balance of skills, experience, problem-solving, and innovation. It helps companies with diverse boards gain up to €51.8 billion advantage.

The study has also found that effective boards should have directors between 30-75 years old for maximum age diversity.

Board evaluation methodology explained

Board evaluations are crucial to succession planning and long-term business growth. Leading consulting firms, like Deloitte, suggest the following board leadership and effectiveness parameters.

| Board leadership components | Evaluation parameters | Indicator example |

|---|---|---|

| Structure | ▪️ Size ▪️ Composition ▪️ Diversity ▪️ Skills and experiences | ▪️ Total number of board members ▪️ Age, educational, and social background ▪️ Number of diverse members ▪️ Board skills matrix ▪️ Individual directors’ skill matrix |

| Process | ▪️ Meetings ▪️ Information flow ▪️ C-suite integration ▪️ Succession planning | ▪️ Type, frequency, participation quality of meetings ▪️ Quality of meeting materials, minutes, agendas ▪️ Level of process digitalization ▪️ Frequency and quality of C-suite interaction ▪️ Strategic alignment of succession plans ▪️ Director tenure |

| Corporate governance role | ▪️ Company’s strategy and risk alignment ▪️ Sustainability oversight ▪️ Policy monitoring | ▪️ Percentage of strategic goals completed ▪️ Quality of financial controls ▪️ Quality of whistleblowing mechanisms ▪️ Percentage of completed ESG goals ▪️ Percentage of monitored policies ▪️ Degree of policy compliance ▪️ Quality of stakeholder engagement mechanisms |

Board evaluation methods

There is no universal board evaluation methodology — companies may use self-assessment surveys and interviews. Over 40% of Fortune 100 companies use questionnaires, while 30% combine questionnaires and in-person interviews. These days, more companies insist on external evaluations by professional firms, but such services are still unpopular among corporate boards. Only 25% of Fortune 100 companies involve third-party professionals to evaluate board performance.

| Board director evaluation method | Pros | Cons |

|---|---|---|

| Anonymous survey | ▪️ Anonymity encourages honest feedback ▪️ Quantifiable data allows for in-depth analysis ▪️ Standardization ensures process consistency | ▪️ The self-assessment nature of questionnaires may cause superficial answers ▪️ Standardization provides limited context |

| Interview | ▪️ Personal connection ensures in-depth insights and clarifications ▪️ An interviewer can adapt questions on the fly | ▪️ It’s a resource-intensive process ▪️ The interviewer’s bias may impact the results |

| Peer assessment | ▪️ It provides diverse perspectives on the director under evaluation | ▪️ Biased peers may be reluctant to provide constructive feedback ▪️ It may create personal issues among fellow directors and slow board dynamics |

| Stakeholder feedback | ▪️ It provides an unbiased external perspective ▪️ It delivers comprehensive insights into the board’s functioning ▪️ It encourages accountability | ▪️ Media coverage and other external factors may portray the company inaccurately and influence stakeholders’ perceptions |

| Meeting observation | ▪️ It provides direct first-hand insight into the boardroom dynamics ▪️ It provides an accurate understanding of the board’s decision-making and discussion processes | ▪️ Board directors may act beyond their usual conduct if observed by external auditors |

| Check our board assessment guide to enhance your board evaluation methods and practices. |

Board evaluation significance: Salesforce case study

Some companies may lack board control measures, excessively relying on directors’ goodwill. Such boards limit themselves to self-assessment questionnaires, which provide poor insights into board functioning. Inadequate board assessments may lead to questionable strategic decisions and deteriorate the company’s business performance.

Salesforce is an example of this issue. It’s a leading cloud software company with $247 billion in market capitalization and over 70,000 employees. Salesforce’s EPS declined significantly in 2021-2022, while its profits remained flat for five years, according to Macrotrends. By the beginning of 2023, its EPS declined by 85.8%.

The company was criticized for its inadequate acquisition strategies. At the same time, Salesforce’s board conducted only annual self-assessment questionnaires. Most importantly, its nominating committee was reluctant to change its leadership for a long time. Many of its current board directors have been serving for 10+ years, and some have been in the company for nearly two decades.

However, in January 2023, Salesforce appointed three new board directors, after it faced significant pressure from stockholders and investors, including Elliot Management, the biggest of all institutional investors.

The company nominated Mason Morfit, CEO & CIO at ValueAct Capital, a hedge fund with strong experience in transforming software companies. Mason has been serving as a board director since March 2023. The other two directors are Sachin Mehra, CFO At Mastercard, and Arnold Donald, President and CEO of Carnival Corporation & plc.

The results of this leadership change have so far been very positive. Salesforce’s earnings per share (EPS) and net income increased 205.7% and 194.4% since the beginning of 2023 (YoY change). The Salesforce stock price has also been steadily growing since January 2023.

| ✅ Main insight: The Salesforce case highlights the importance of robust board evaluation measures (Salesforce doesn’t have any in place) and a timely change of leadership. In such scenarios, accepting stakeholder feedback is critical for the company’s future. |

Board of directors composition requirements

Specific corporate governance laws regulate the composition of corporate and non-profit boards. Let us describe the US legal requirements for the board structure under the following categories:

As for age, specific skills, and experiences, no set-in-stone board of directors composition rules for corporate and nonprofit boards exist today. Each organization decides on these parameters individually.

Size

Size requirements for the board of directors composition are the following:

| Corporate guidelines | Board size requirements |

|---|---|

| Delaware General Corporation Law | ▪️ At least one member for a corporate board. ▪️ At least one board member per committee. ▪️ Board directors should not be stockholders. |

| Washington State | ▪️ At least one member for a corporate board. ▪️ At least two members for the board of directors committee composition. ▪️ Board members should not be shareholders unless otherwise stated in the company bylaws. |

| Securities Exchange Act of 1934 | ▪️ Independent directors must comprise the majority of board members of public companies. |

| Sarbanes-Oxley Act (SOX) | ▪️ A board must have an audit risk committee with all independent directors. |

Diversity

Board diversity became more regulated with the SEC’s approval of the NASDAQ Board Diversity Rule in 2021. According to NASDAQ, public boards should meet the following requirements:

- Companies with five or fewer directors should have one diverse director.

- Companies with boards of five members should have one female director and one LGBTQ+ director.

- Smaller reporting companies should have two female directors or one female and one LGBTQ+ director.

- Foreign issuers should have two female directors or one female and one underrepresented individual.

Optimal composition of board of directors

The ideal composition of for-profit board of directors has the following characteristics.

| Board composition aspects | Best practices | Benefits |

|---|---|---|

| Board size | Between seven and ten members | ▪️ Smooth company’s governance ▪️ Easy decision-making ▪️ Sufficient board engagement |

| Age diversity | Between 30 and 75 years | ▪️ Innovation opportunities ▪️ Broad business perspectives ▪️ Efficient challenge management |

| Skills and expertise | Experience relevant to the organization’s goals, including legal, financial, managerial, and cybersecurity. | ▪️ Informed decisions ▪️ Balanced board performance ▪️ Stakeholder confidence |

| Diverse backgrounds | One or two diverse members, including racial, cultural, gender diversity, etc. | ▪️ Unique perspectives ▪️ Good customer understanding ▪️ Regulatory compliance |

For maximum business growth, apply the following board composition activities.

Ensure continual board refreshment

Most boards struggle with talent refreshment and succession planning. According to the National Association of Corporate Directors, talent competition is a primary concern for 77% of board members.

PWC suggests embracing a strategic approach to board refreshment, including the following activities:

- Term limits. The company sets a clear tenure guideline and ensures the board consists of new, middle, and long-tenured directors.

- Planned departures. The company plans board turnover several years ahead, considering individual director tenures.

- Talent pipelines for board candidates. The board develops well-structured candidate profiles based on anticipated changes and skill gaps several years in the future.

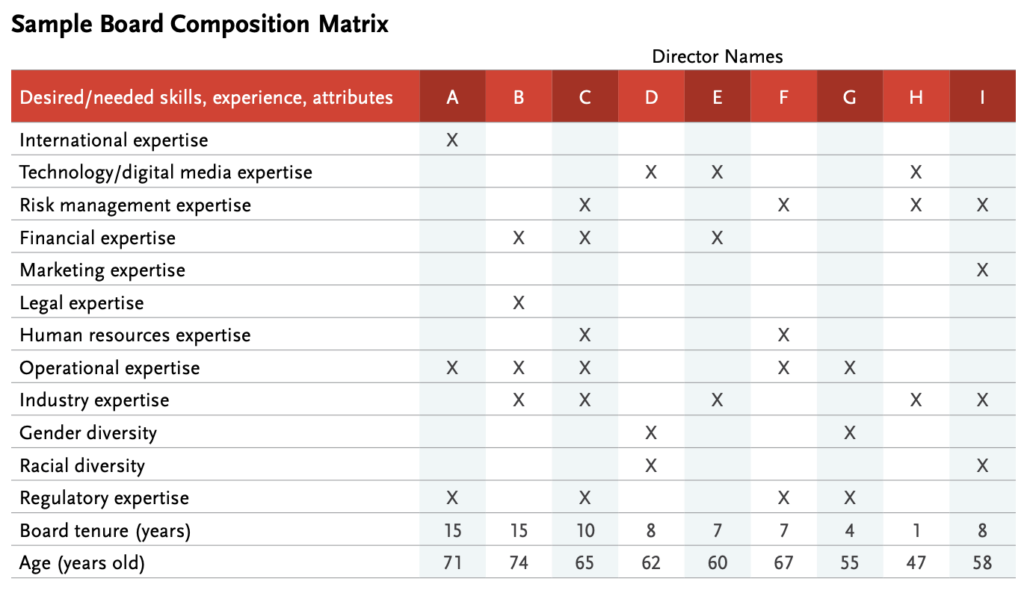

Use a board skill matrix

According to Deloitte, many companies use board skill matrixes to assess board makeup, identify expertise gaps, and recruit new directors. A skill matrix is a set of board governance skills aligned with each board member.

Deloitte also emphasizes that a skill matrix alone doesn’t provide sufficient data on recruitment choice. A board should combine skill matrices with directors’ CVs if it nominates new members.

Consider director independence

According to NASDAQ, an independent director is a person who:

- Hasn’t been a company employee for at least three years (relates to current or former CEOs).

- Has no family members working for the company.

- Has no relationship with the company that may compromise their objectiveness.

Independent directors pursue the best intentions for the company’s shareholders, customers, and employees. These board members ensure higher shareholder confidence and business resilience.

Use board management software

Boards dedicate substantial effort to strategic matters, like auditor and stakeholder communications, accounting, subsidiary issues, or private equity relations. They often need more time for board’s composition management.

Therefore, many companies use software for board of directors to address internal questions, like board structure, and external matters, like local county relations.

A board portal is a secure workspace with dedicated tools for board duties, like material information sharing, voting, recruitment, project planning, board meetings, etc. Board portals provide many benefits for board composition, including but not limited to the following:

- Strategic board refreshment. Track multiple director tenures and plan departures using dedicated task workflows.

- Data-driven skill assessment and accountability. Use activity and data access tracking tools to evaluate board effectiveness, identify skill gaps, and plan future board refreshment cycles.

- Smart talent recruitment. Build skill matrices for new board members, and plan online board meetings in a highly secure environment.

Nonprofit board of directors composition

In America, businesses and nonprofit organizations have slightly different requirements for board makeup. In many states, including Minnesota and Texas, a nonprofit board should have at least three members, including one board chair and one secretary.

The Minnesota Council of Nonprofits suggests recruiting at least seven board members for optimal governance.

Typically, the non-profit board of directors structure consists of the chairman, secretary, treasurer, and a few more board officers. A nonprofit may also have a CEO as a voting member on its board.

The nonprofit board makeup also varies in size. For example, hospital board structure or board structure of civil organizations, like New York Liberties Union, may have over 30 board members.

The nonprofit board structure also varies in size. Some healthcare and, especially, civil organizations, like New York Liberties Union, have over 30 board members.

Nonprofits can consider all board structure recommendations that apply to corporate boards. They will also benefit from board portals.

The Board-rooom.org team recommends Ideals Board as an affordable, reliable solution with innovative security features and abundant board workflows.

The two most impactful tips to achieve board excellence

1. Emphasize strategic matters with a heavy impact on business performance

The Harvard Business Review survey of 750 board directors identified insightful correlations between board practices and firm performance. The study reveals that great boards pay less attention to financial statements, audits, and compliance.

Instead, they emphasize strategic planning, M&A activities, and C-suite succession. It helps each director become an effective board member, focusing on the true value drivers leading to business excellence.

| Topics discussed by top-performing boards | Discussion likelihood compared to average boards |

|---|---|

| Strategic planning | 10% increase |

| M&A oversight | 7% increase |

| C-suite succession planning | 6% increase |

| Financial statement reviews | 17% decrease |

| Audit-related activities | 8% decrease |

| Compliance activities | 7% decrease |

| Get a board effectiveness checklist to improve boardroom performance. |

2. Promote active participation and discussion among board members

McKinsey’s Global Survey on boards has revealed that boards of high-performing companies apply the following practices for the highest impact on business performance.

| Board practice | Benefits for business performance |

|---|---|

| Provide sufficient onboarding support to new directors. | New members maximize leadership potential. |

| Seek business info beyond reports provided by managers. | Board directors get in-depth knowledge of business matters and make more informed decisions. |

| Organize exclusive discussions between non-executive board members at each meeting. | Non-CEO time at each board meeting creates more candid and impactful discussions and produces more decisions benefiting business performance. |

| Check this onboarding guide to help new board members realize their full potential from the first days in your organization. |

Time to use the modern board management software!

Ideals Board serves board of directors, committee members with a comprehensive suite for governance tools

Visit WebsiteKey takeaways

Let’s summarize the most essential points from the article:

- Board composition is the set of characteristics of board directors, including their age, experiences, skills, and backgrounds.

- Board structure best practices include revising director tenures, emphasizing cybersecurity, promoting age diversity, and keeping the board size small for optimal governance.

- Boards are advised to use board management software to fulfill the board makeup approaches efficiently.

FAQ

Does the composition of a board of directors make a difference?

The composition of a board of directors directly impacts stakeholder confidence and corporate strategy and performance.

How does composition impact organizational performance?

An independent, experienced board makes informed decisions, prioritizes the organization’s performance, and carefully plans accident management.

Professional directors’ good governance contributes to higher business growth and better risk abatement. In contrast, the implications of a mismatched board may be devastating.

How can nonprofits ensure an effective board composition?

Strategic board refreshments, expertise focus, age diversity, and dedicated board management software help nonprofits achieve a positive effect on the board makeup.